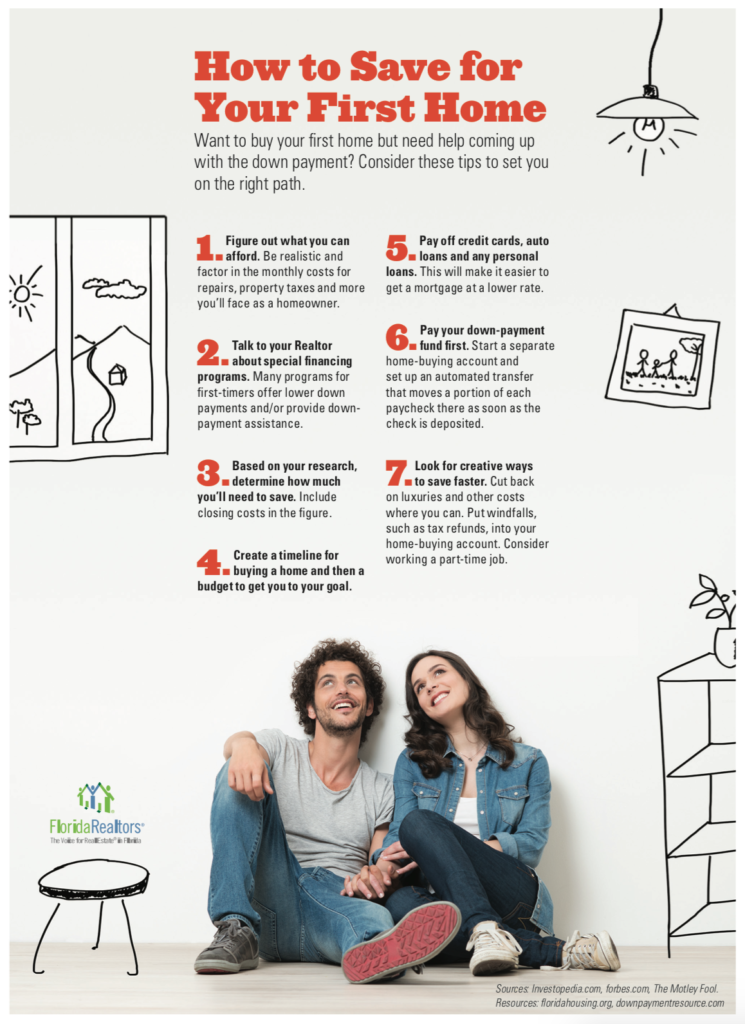

If you are trying to get out of the rental game and jump into a home of your own, you may feel a little overwhelmed. Where do you start? How do you save for the down payment? What will the payments look like? Consider these tips to set you on the right path.

Figure out what you can afford

Be realistic and factor in the monthly costs for repairs, property taxes and misc monies you’ll be spending as a homeowner. Talk with family members and friends about the additional costs they incur so you can gauge an estimated amount. If you are planning to use air conditioning or want a pool, go onto the local utility company websites and see if they have a calculator for estimated monthly usage. The more information you have about the potential costs, the less surprises will pop up in the future.

Talk to your relator about special financing programs

Many programs for first-time home buyers offer lower down payments and / or provide down-payment assistance. You may also be able to ask for seller concessions in your offer that can help cover closing costs. So ask your realtor if they can refer you to a lender who specializes in first -time buyers. Lenders can answer all your questions and walk you through what will be needed. It’s important to use a team (realtor / title agent / lender) who will take the time to explain what’s happening instead of rush you through the process. This is most likely the largest purchase of your life, so make sure you have the right team to help you achieve your goal.

Based on your research, determine how much you’ll need to save

When it comes to purchasing a home, it’s not just the down payment and cost of the home you have to factor in. Closing costs will be above and beyond the price you agreed to pay for the home. These can included title fees for searches, taxes and assessments, disbursements, lender fees, commissions, surveys, appraisals, initial insurance and mortgage payments, etc. Think of closing costs like a one time payment that bundles everything you need to close into one transaction.

Create a timeline for buying a home and then a budget to get you to your goal

When do you want to be in your new home? If you have a goal of 6 months, you should start looking and saving now. Depending on financing, it can take anywhere from 30-60 days to complete the transaction. So you’ll want to have an accepted offer at least 2 months prior to your move in date / goal. Above all, don’t rush the process. Adjust your timeline as necessary instead of sprinting to the finish line. Planning and setting goals are a great way to monitor your progress.

Pay off credit cards, auto loans and any personal loans

Or at least, pay them down as much as you can. This will make it easier to get a mortgage at a lower rate. If you are serious about buying, start working with a realtor and lender now. Your realtor will keep you in the loop when new properties hit the market or when pocket listings come available. This will help you stay on top of properties instead of always looking at the homes that have been stagnant for months. Your lender will provide ways for you to improve you score and income/debt ratio BEFORE they have to run your information officially. This gives you a testing ground to see how much you can save before it’s time to commit or quit.

Pay your down-payment first

One of the easiest ways to save your down payment is by moving funds into a separate account. Have a savings account that hasn’t see a lot of activity lately? Start moving monies, however much, into that account. Using a separate account makes it easier to see how much and how quickly you are able to save. If you don’t want to touch what money you have saved already, open a new account. Another way to help bulk that account up is to set up an auto transfer every pay day. The quicker you have your downpayment, the sooner you can start making offers. DO NOT write an offer without having your downpayment in full. This will only cause issues down the line.

Look for creative ways to save faster

Cut back on luxuries and other costs where you can. Put windfalls, such as tax refunds, into your home-buying account. Smaller expenses like Netflix, hulu, dropbox, etc. may not seem like a lot, but they add up quickly over time. Consider cancelling them for a few months. Pack lunches, only get gas at the gas station, have a picnic on the beach for date night. Anything that keeps money in your account, do it.

Buying a home can be so exciting and such a liberating experience if you have been renting for a while. Knowing that you’ll be building equity with your payments instead of lining someone else’s pockets is a pretty good motivator. And, using these tips and tricks to get started can help the process go a lot smoother. Don’t be intimidated by the housing market. Start with a team that can help you achieve your dream. And call us with any questions!

Credit: FloridaRealtors – Visit the Florida Realtors site here

You have a great idea to use a separate account to save up for a down-payment. My wife and I are thinking of buying a home together. It’d be nice to move somewhere out in the country, where it’s a little quieter.

It makes sense that you consider the costs of maintenance and repairs when looking for a house. My wife and I are looking for our first home, but we are on a strict budget and don’t want to buy something that we will regret financially. We will see if we can find a real estate service that will help us look at our options.

What you said about how one should consider paying off any kind of debts before jumping the gun and buying a house is something I agree with. My brother is thinking of purchasing his first home within the year and he’s looking for tips on what to expect before doing so. I should share this with him so he’s aware of what he’s going into.