MORTGAGE DEAL BREAKERS

|

| There is nothing wrong with the above statements, but unfortunately the bad apple borrowers have spoiled it for new borrowers. It is completely understandable that consumers would think twice about having to “jump through hoops” just to get a mortgage – especially in situations where they have stellar credit, lots of liquidity, and consistent earnings.

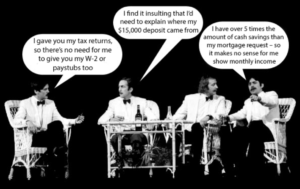

But lenders and regulators needed to stop the games being played:

It really does make sense that all borrowers should be required to show they have an “ability to repay” their mortgage. Fannie Mae, Freddie Mac and FHA do not give special treatment to anyone – and therefore no one is viewed as being more entitled than anyone else. Just because someone has significant cash or retirement savings doesn’t mean they won’t use it for some other purpose right after the loan closes – i.e., to buy a business, a large boat or some other investment. Such a purchase could leave next to nothing for mortgage payments. Therefore, even someone with a large 401k or IRA needs to establish a monthly income distribution to satisfy a lender. It could be more economical to borrow money instead of selling investments that have adverse tax consequences. But it would be far less costly, less time-consuming and less frustrating to instead arrange a margin loan collateralized by an investment portfolio. Here’s the Point: No one is entitled to special treatment in the conventional or FHA mortgage world. |

Action Realty, LLC

709 Washington St.

Sebastian, FL 32958

(772) 581-8814

Contact Action Realty

Why Choose Action Realty?

If you are looking to buy or sell real estate, it's best to be well informed and work with a professional with the experience you need.

Our agents are here to help you through every step of the process, from finding the right home, staging, negotiations, and vendor management. We've got you covered.

Meet Our Team

Meet Our Team

Leave a Reply